Paga Virtual Prepaid Card: How It Works

Do you want to own a Paga virtual prepaid card? Or do you already have one? Whichever one, you will find this article interesting as it further shows how Paga virtual prepaid card works.

The Paga virtual card is an alternative payment card, designed for simple, safer, and faster online transactions or for use at Paga agents.

It has its own 16-digit card number, CVV, and expiry date, that’s different from your physical prepaid card, giving you an extra layer of security when spending online.

You can create and save a virtual card instantly on your mobile phone via the app and load it with cash.

Like every prepaid card, you can only spend the balance you have available on the card.

Unlike a regular debit or credit card, a prepaid debit card doesn’t need to be linked to a traditional bank account.

Prepaid payment cards are popular among ‘unbanked’ people who can’t access traditional banking services or don’t want to.

See Also: Nigerian Banks And Their Customer Care Numbers

How to create a Paga virtual Prepaid card

To open a Paga account and get a prepaid Visa, you must be aged 18 or over and be a resident of Nigeria to sign up.

To create a virtual card, simply follow the below steps

- Download our free mobile app from the App Store or Google Play

- Sign up with your phone number, email address, and mention where you live. You’ll also be asked to verify your phone number and provide a selfie to confirm your identity

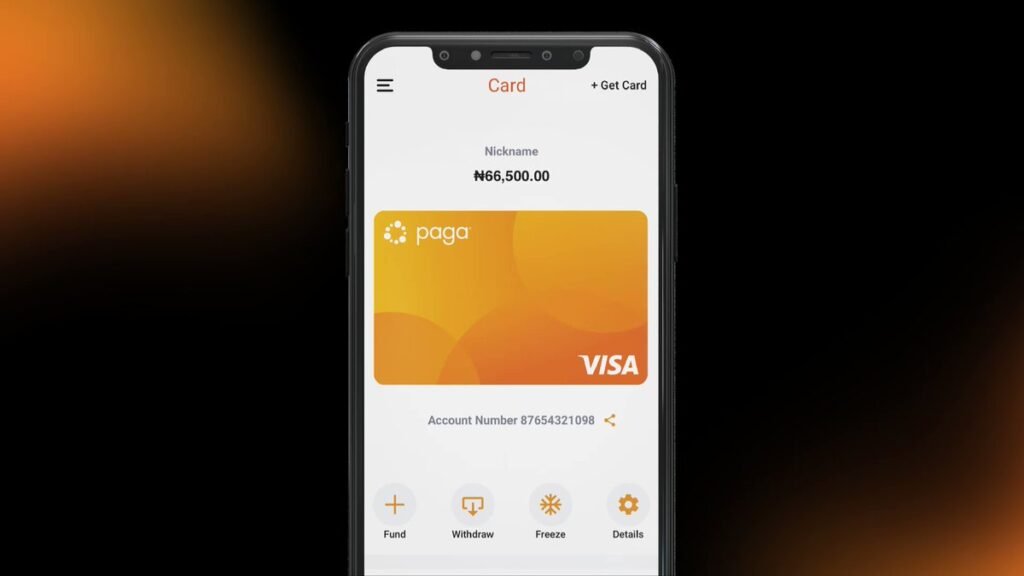

- Login to the Paga app and Click on “Cards” on your dashboard or menu

- Click on “Get Card”

- Swipe to the Virtual Card tab and select a card type to create your virtual card

- Make it memorable by giving it a nickname

- Confirm your payment

- Tell Paga where to send your card or pick up the card at any of their agent locations

It’s that easy! Your card is ready and you can start spending after you fund your virtual card. No PIN is required for your virtual prepaid card.

And yes, you can have multiple virtual cards and you can nickname your cards based on your preference.

How to fund Paga virtual card

There are two types of Paga Virtual Cards: Naira Virtual Card and Dollar Virtual Card.

Adding money to your virtual card is quick and easy.

You can fund directly from your Paga app using your Paga wallet, linked debit card, or bank account.

Alternatively, your virtual naira card comes with a unique Paga NUBAN (different from your primary Paga account NUBAN) that allows you to receive money from any Nigerian bank or financial institution straight to your virtual card.

Simply share your card account number and ask your friends to transfer cash directly to your card from their bank account.

With a prepaid Visa card, you can add money in lots of different ways. Many of them are quick and easy to do from your Paga app.

- Make instant top-ups from another debit card

- Receive bank transfers

- Transfer money between your Paga accounts for free

- Request payments from friends

- Get paid by your employer

- Top up with cash at more than 20,000 Paga agents across the country

Your Paga card will work anywhere that Visa is accepted including physical shops and online stores, as well as ATMs worldwide.

Paga virtual card limit

The limits on your virtual card is applicable to the type of transaction. Here’s a quick summary of the transaction and balance limits on your virtual card.

Virtual Naira Cards

Please note that funding your virtual card is subject to the applicable KYC transaction limits on your primary Paga account.

See Also: How To Register For GTB GAPS Online In Nigeria

How to disable Paga virtual card

For added security and peace of mind, you can temporarily disable transactions on your virtual card at any time in your Paga app.

Follow these steps to get started:

- Login to your Paga app and Click on Cards

- Click on your active virtual card

- Click on Freeze card and transactions will be immediately disabled on your card.

- To allow transactions on your card, you just need to follow the same steps and click Unfreeze card

If you want to completely delete your virtual card, you’ll need to follow steps 1 and 2, then click on Details and select Delete card to completely disable transactions on your card. Please note this process is irreversible.

And when your card expires (even before it expires) you will be notified about how much time you have left before the expiration date.

You will also be given the option to request a new card or transfer your card balance to your PAGA wallet within the expiration window on the app.

Benefits Of Using Paga Prepaid Card

- Easy to get – A prepaid card account is an easy alternative to traditional banking for ‘unbanked’ people as there’s no complex KYC requirement. With a Paga Card account, you can then receive your salary, pay bills and much more.

- Easy to manage – Prepaid debit cards are useful for managing your money as you’ll never be able to spend more than the balance you add. A Paga card also makes it easy to transfer and receive money, track spending and create savings Pockets, right from your phone.

- Keep your funds safe – Prepaid cards are safer than carrying cash around. You can still use a Paga card to get cash out from an ATM whenever you need to, just like you would with a regular debit card.

Paga Prepaid Debit Card: Safe Or Not?

- Prepaid debit cards are a safer and more convenient option than carrying cash. But there are lots of other ways that we keep your Paga card, money and identity safe too.

- Use a virtual card with a unique card number for secure online shopping

- Lock your Paga Visa card instantly in-app if you lose it

- Your prepaid debit card account is protected too with single-phone access and much more. Read about security with Paga.

Article updated 4 months ago ago. Content is written and modified by multiple authors.