Looking for an efficient and secure way to open a GTB Domiciliary Account online? Here’s your guide. Learn how to get started with the easy steps in this article.

I have been operating Gtbank domiciliary account for more than 3 years now (since 1st quarter of 2017) and even better, I know people that have had this Gtbank account for about 5 years. I have recommended it to numerous people that I think needed it.

To cut the story short, I represent virtually more than half a decade of knowledge on Gtb dom account. This article is presenting you with first-hand information and if thoroughly followed, you can be a domiciliary account holder in Gtbank in less than a week.

Hey there! Relax. It is not like the registration is hard or something. But if not careful, can be stressful and frustrating like in my case last year even though I had people put me through the necessary steps.

See How to Block GTB Debit Card Online incase of loss or fraud as well as How To Get GTB Visa Dollar Debit Card

Gtbank Domiciliary Account 2024

Some are reading this article on how to open GTB domiciliary account online because they probably urgently need the information while it is just another educational or eye-opening article for some.

Therefore, there is a probability that you, reading how to open GTB domiciliary account online right now haven’t heard of a domiciliary account before, or if I rephrase, you are hearing this banking term for the first time and will like to know what it is all about.

What Does it Mean?

Before I delve into how to open Gtb domiciliary account online, let’s see what it means first. Well, in layman’s terms, a domiciliary account is basically another type of bank account but in its case, transactions are in foreign currencies.

You can open this account with almost all the banks in Nigeria but Gtb, First Bank, and Stanbic IBTC are preferred. Some friends keep complaining about Access and Zenith bank always saying they don’t have dollars on ground.

So what is the essence of the dom account if you can’t withdraw your hard-earned money? You might want to stay clear of those two except you are sure of the branch in your vicinity as I understand the case might be different with each branch.

Therefore, you can simply say Gtb domiciliary account is a type of account that allows you to manage or transact in foreign currency through guaranty trust bank plc.

However, my Gtbank domiciliary accounts are listed as current account on my Gtbank internet banking profile. And I was able to open Dollar, Pounds and Euro dom account with the bank. You can also open a CFA franc (8 west African countries’ currency) account if you want.

I advise people to open all the accounts even though they don’t need them right now or at least the major ones that I opened. Why? Because you can’t be sure what the future holds for you, it might be needed when you won’t have the time to visit a bank to open one.

But you also need to be aware the account will become dormant if it is inactive for over 6 months. Not to worry though, you just have to visit any branch of Gtbank with any of the forms of identification listed later in the article to activate it again.

Gtbank Domiciliary Account Minimum Balance

Looking for the minimum balance for a GTBank domiciliary account? The good news is, you don’t need to worry about any kind of minimum balance requirement – the minimum opening balance for a Domiciliary account at GTBank is zero.

Why Do I Need it or What are its Advantages?

The advantages of Gt-bank domiciliary account are intangible, especially to digital marketers (Bloggers, Freelancers, etc) who work with companies that pay in USD, GPB or EUR and also to online shoppers (and you know we have many of us) in Nigeria.

Basically, the advantages revolve around payments (receiving and sending/paying).

1.) Bloggers, Affiliate Marketers & Related

Most Nigerian bloggers monetize with Google which pays in USD while numerous others that operate Amazon or other affiliates also receive payments in US Dollars.

Receiving foreign currency into savings account is a gain to the banks but a loss for you. Why? Let’s answer that with basic calculation. Lol, by now you must have known how much i love calculating.

Let’s say one of the aforementioned companies paid $100 into your savings account, gtbank will convert it to Naira for you at the rate of 750 Naira per dollar.

- 1 US Dollar – 750 Naira.

- 100 US Dollars – X Naira.

Cross multiplication gives, X = 100 x 750 = 75,000 Naira.

That’s (i.e) $500 will amount to 375,000 Naira and $1000 = 750,000 Naira.

But if you are to receive the money into your gt-bank domiciliary account, you can walk into any of the numerous gtb branches to withdraw and change at black market (from aboki) rate of dollar to naira which currently fluctuates between 357 – 360 Naira per dollar.

Meaning $100 will gives 35,700 – 36,000 Naira. That’s at least 4,200 Naira difference compare to the 31,500 Naira at bank rate.

Now we have pro bloggers in Nigeria that makes nothing less than $2000 per month. That is 714,000 – 720,000 Naira at black market rate (357 – 360 Naira per dollar) which at bank rate (315 Naira) amounts to 630,000 Naira.

That’s 84,000 Naira discrepancies. I believe now you understand why you need to open a gtbank dom account as a blogger in Nigeria.

2.) Online Shoppers

If you shop a lot on foreign sites and also probably make money in foreign currencies, you also need a dom account(s).

Because it will eliminate the spending limit of the Naira master card on foreign sites and also erase your worries about the Gtbank exchange rate which also currently fluctuates between 365 – 368 Naira to a dollar on the Gtb Naira Master card.

In short, you will be opening a domiciliary account so you can apply for a Gtbank dollar MasterCard which is what you will be using to shop online.

How to Open Gtb Domiciliary Account Online{Pounds, Euro, CFA & Dollar}

Do you want to know how to open Gtb domiciliary account online? Having fully understood what Gtb domiciliary account is, you can now proceed to open one for yourself. All you have to do is walk into any branch of Guaranty trust bank nearest to you.

But before you do that, I think you might learn one or two things from my own experience.

I said earlier that I had a case while opening my own account that made the process stressful and frustrating. Below is my experience.

Yes, I was told I needed two referees (current account holders) to fully activate the account but I didn’t know salary current accounts weren’t suitable which was what I presented to Gtbank.

The accounts were opened and I was sent the account numbers via SMS and email after 2 days. It was pretty fast and I was happy which only lasted for 2 days because I received another set of messages saying my referees were not suitable and my account will remain not fully activated until suitable ones are presented.

What they meant by not fully activated was that I can receive money into it but I can’t withdraw from it. And do you know the most annoying part? The payment which I usually received with my Naira savings account was redirected into the dollar domiciliary account which I can’t debit from. It was frustrating.

It took me another three days to get them to tell me why the previous ones are unsuitable. The reason being they are salary current accounts. My point is: make sure you have suitable referees before initiating the registration process.

Requirements on how to open Gtb Domiciliary Account Online

Below are a couple of requirements needed to get started. Make sure you have all of them before you start the process.

Referees: You must have two current account holders (salary account is unsuitable) preferably of Gtbank that are ready to fill and sign the reference forms. Other banks are accepted but confirmation and activation may take weeks if not months.

Identifications: For personal details confirmation, you will need one of these: (Nigerian International Passport, Permanent Voters Card, National ID Card, or Driver’s License).

Utility Bill: For address confirmation, you will need a water or electricity (Nepa) bill issued within the last three (3) months.

Passport Photograph: Not really sure why they need this, but you need one (1) taken within the last 3 months.

Gtbank Naira Account: You need to have an existing account with Gtb that is Naira denominated it can either be savings or current. If it is current, you may not need referees as you must have already presented them upon opening the current account.

Also, if you don’t have an existing account with the bank, you will have to open at least a savings account before the domiciliary account.

Gtbank Domiciliary Account Application Process {Step by Step Guide}

I will assume you have met all the above requirements, especially the referees. Now follow the simple guide below whether you are a new or an existing customer.

- Visit any branch of gt bank close to you and go straight to the customer care section.

- When assigned an agent, let him/her know you want to open a domiciliary account in Gtbank.

- He/She will then give you a Gtb domiciliary account opening form to be completed by you and 2 reference forms to be completed by your referees.

- Know that you are free to open all the available dom accounts (USD, GPB, EUR & CFA). You just have to check the boxes preceding them.

- Select email as method of receiving transaction alert to avoid the charges that comes with sms alert.

- If your referees lives nearby, you can quickly fill the opening form and visit them to complete the reference forms.

- Once you done with that, go back and submit the forms so they can initiate the registration process.

You will be submitting the reference forms, account opening form, copy of your ID (Go with the original, they will make a copy themselves), a passport photograph and utility bill. Expect your account number(s) in 48 – 72 hours.

To speed up the process, make sure your referees are Gtbank current account (salary account is not suitable) holders and are reachable.

You can also present current account users of other banks, but it might takes more time to get your account fully activated.

Once your account is active, all foreign currency sent to your Naira-denominated savings account will be forwarded to the appropriate domiciliary account. You can unlock the full potential of your Gtb dom account by applying for a dollar card.

Guaranty Trust Bank Domiciliary Account Charges & Monthly Limitations

Opening an account is free but you need to fund the account to activate it. If you do not perform any transaction with it for 6 months, it will become dormant.

- Withdrawal Limit of $1000 Monthly.

- Daily & Weekly Transfer Limit of $10,000 and $50,000 respectively or its equivalent in other currencies.

- There is No spending limit on WEB and POS. But you need gtbank dollar card (Will talk about this in next article).

- Transfer to other domiciliary accounts attracts a charges of 1% of the amount you are transferring plus a swift charge of 4000 Naira.

There has been an increase in the transfer charges. Because it was 0.5% of the transaction and 5% of the 0.5% (VAT) or a minimum charges of 10.5 USD. If you calculate the charges, you will notice that the minimum charge of 10.5 USD was actually for $2000 transfer.

I mean 0.5% of 2000 = $10. And 5% of 10 USD is 0.5. Total = 10.5 Dollars. So all transfer made between $1 – 2000 US Dollars used to attract a charge of $10.50. And you would have to use the same procedure to calculate for the transfer above 2000 Dollars.

But that doesn’t matter anymore since the transfer charges have been revised to 1% plus 4000 Naira.

How to Fund Gtb Domiciliary Account

Your dollar, euro, pound and cfa dom account(s) can be funded through any of the following means.

- Cash Inflows: Payments from the likes of Google & Amazon.

- Bank Cash Deposit: You need to buy the foreign currency from bank or abokis and deposit.

- Lodgment of Foreign Currency Cheques.

- Travelers Cheques.

Gtb Domiciliary Account FX Transfer

You can transfer from your domiciliary account to your dollar account, to other gt domiciliary accounts or to other Nigerian banks domiciliary accounts. You can make the transfer using gtbank internet banking platform or GTWorld (Gtbank modern mobile banking app).

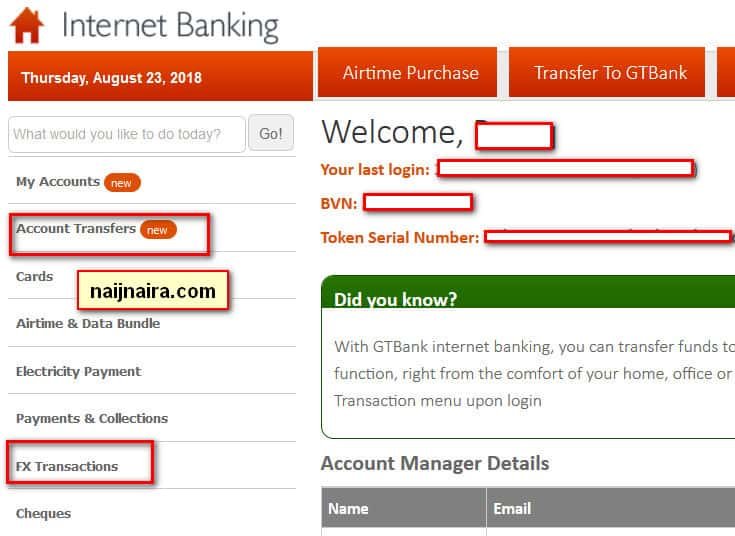

Using Internet Banking Platform

- Navigate to your gtbank internet banking dashboard.

- Click on FX Transactions at the left side bar of the dashboard for other dom accounts.

- To transfer to your card account, click on Account Transfers.

- From the drop down menu, select “FX transfer to gtbank” to transfer to another gt dom account or “FX Transfer to other banks” to transfer to other banks or Own Account to transfer to your Card Account.

- Click on Add New Beneficiary and fill out the receiver’s dom account details.

- Authenticate the transfer and that’s it.

Using Mobile App (GTWorld)

Gtworld is guaranty trust bank modern mobile application that comes with a lot of features. Among them are performing basic transactions without signing in, transferring with phone numbers, biometric sign in and authentication, FX transfer etc.

To transfer dollar, euro or pounds from your domiciliary account to another dom account in Nigeria;

- Login to GTWorld.

- Tap on transfers.

- Under Transfer Type, select Own (to transfer to your card account), FX Transfer to Gtbank (to transfer to another gtb dom account) or FX Transfer to Other Banks (to transfer to other Nigerian banks dom account).

- Select which of your account to debit (dollar, euro, pounds, cfa).

- If you are sending to other banks, you will have to add the recipient’s to your beneficiary list.

- Once you are done with the forms, you can authenticate using PIN, Fingerprint or Token (compulsory for third party transfer).

How To Check My Gtb Domiciliary Account Balance

To check the balance of your GTBank domiciliary account, you have two options.

Firstly, open the GTBank Mobile App and log in using your user ID and password. Upon logging in, your account balance will be visible on-screen for you to view. You may also swipe to the right to check other account balances.

Secondly, if you are registered for their internet banking service, you can use that to login and check your domiciliary account balance. Your account details and balance will then be available for you online.

And that’s all on how to open Gtb domiciliary account. Was this article helpful? If Yes, kindly share using the social buttons below. If you have any questions, don’t hesitate to use the comment box.

Article updated 3 months ago. Content is written and modified by multiple authors.

34 comments

I’m on y ay this week to open a do acc with gtbank. My friend told me I need a minimum of $200 to own the acc as it is not free, but going through this article, I saw that I can open it without $200 but I can later fund it b4 six month. Can I proceed tomorrow as I dot have $200 on me? Thanks in anticipation.

Yes, you do not need $200 to open a dom account with gtbank. Hope you have other requirements though? Especially the referees.

Hi. So what’s the charge on the GTBank dollar card? Monthly/yearly?

And is there any charge for operating the account?

I recieved money from an asian country and it’s almost four days, yet it hasn’t reflected.. i only used my

Acc name:

Euro Acc number:

Swift: GTBINGLA

hope the details are correct?

It takes 3-5 days. You should get in touch with customer care tomorrow if doesn’t.

Thanks, they said they paid on the 07/10/11, maybe i’ll talk with a customer care on monday

Pls I need 2 referrer for my domiciliary account ,pls anyone from gt bank with current or domiciliary account?

what is the amount required by GTB for opening of Domicilliary (US $) account

Free but you will need 20$ equivalent if you want a dollar card.

A friend told me I can withdraw more than $1000 in a month.

Is it true?

Yes, no limit to how much you can withdraw from your dom account.

Can you make transfers from your naira savings account from Gtb to your Gtb domiciliary acct?

No.

If the dollar rate at the bank is 400/$ can I bring 400,000 to the bank and be credited 1000$?

Yes.

Hello and good evening. I attempted doing this at the GTBank branch here, but they said that the bank don’t do that. Please, do you think another branch would?

You mentioned that CFA franc is one of the domicillary account currencies offered by gtb. Interesting. Have you opened a cfa account with them? Is this information still valid in 2020? Thank you

I had no use for it. So No, i did not open the account but yes, the option is still available.

Hello Razaq,

Thanks for the enlightening article. Is it true that you can no longer withdraw dollars received via transfer over the counter in GTB? My intention was to withdraw my freelance earnings to my GTB dollar account, withdraw and exchange at black market rate. But this aboki that I meant said GTB won’t give me cash dollars and even if they do, it would be $20 denomination and he doesn’t accept $20 bills.

Not true. You can withdraw the money and they will give you in denomination that is available which is mostly 100 USD note.

Hello Barry,

I actually checked GT bank today to withdraw just 100 Euro and I was told GTB does not give cash withdrawal over counter that are inflows any longer. You can only withdraw over counter if you have deposited over counter. And only transfer what you have received as transfer, withdrawal over counter is not possible in that case. As there is shortage of foreign currency in circulation.

Were you able to withdraw over counter in any GT bank?

Do they issue dollar visa card?

I am an fx trader, I just opened my GTbank Dom account with with savings account. My broker requires Online bank transfer for deposit and withdrawal. Please am I going to use the app for for it? What are the requirements for depositing and withdrawing through the same media or do they accept e-wallet like Skrill and how easy to withdrawal with it?

If I received transfer to my dom acct. And according to the new regulation that I cant withdraw cash again when it is transfer. How do I get my money in foreign currency so as to maximize black market exchange rate against bank rate. Is there anyway to transfer it out and exchange for naira at black market exchange rate or rate higher than the bank rate. Thanks.

Unless aboki accepts transfer (which I’m not sure) or if you can send the $$ to a buyer via internet banking, I don’t think you’ll be able to convert your $$ to Naira at the black market rate.

Hey, I noticed a difference of $30 in my inflow which I understand to be the transfer fee which my company made me bear. However my co-workers using dom accounts with other banks were charged only $20 as transfer fee. Is the extra $10 something with gtbank only ?

If I already have a saving account that contains ID card and address confirmation already do I still need to submit them when opening a domiciliary account since and just adding account to the existing one?

Thanks for this article. It’s one of the best reads regarding the subject.

How does one find a trusted place to get dollars or pounds to fund the domiciliary account ?

Once the account is opened, is there a minimum balance that must be maintained in the account to keep the account active?

No.

Can my domiciliary account become inactive due to non usage over a long period of time? If yes, can I still do funds transfer into and out of such an account?

But the process is so stressful, they requested for a lot of documents or is it the branch I tried it

The process remains but a lot I d things have changed as at Nov 2020 . Especially the figures.

Another serious and major challenge is getting the account funded if you don’t have paper hard currency money at the moment. Converting naira to dollars now is like catching smoke with your bare hands.

Who has a better option

These requirements, are they applicable to NGos?

Comments are closed.